When customers shop, they often do so digitally. A seamless online payment experience is no longer a luxury—it’s a necessity. Customers expect quick, secure, and hassle-free transactions, and if they don’t get it, they’re likely to abandon their carts and head elsewhere. Research from Baymard Institute shows that 22% of US online shoppers have abandoned an order solely due to a “too long or complicated checkout process.”

This is where the right payment gateway, seamlessly integrated with your Salesforce CRM, becomes a game-changer. A smooth payment process can significantly impact your conversion rates, reduce cart abandonment, and ultimately boost revenue.

But with so many payment gateways available, how do you choose the best one for your business needs?

This blog post will delve into the top payment gateway systems that integrate seamlessly with Salesforce, offering efficient and user-friendly experiences that keep your customers happy and your sales growing.

Salesforce and Payment Gateways Streamline Online Transactions

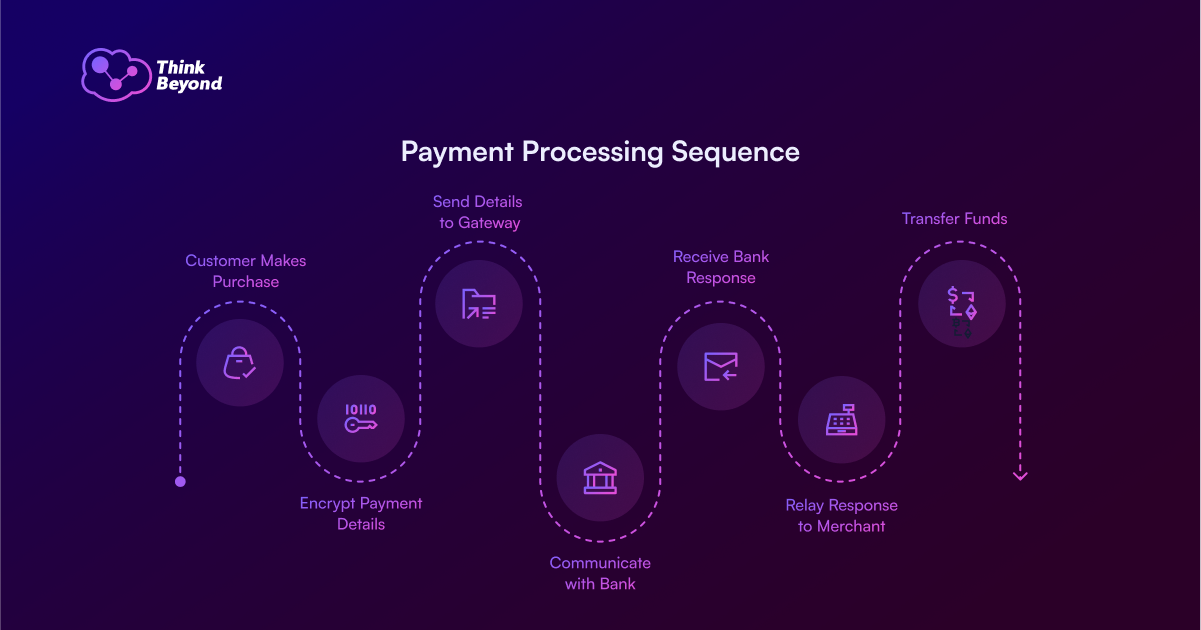

Payment gateways are crucial for integrating e-commerce functionality with Salesforce. They act as intermediaries, securely processing online payments from customers and transferring funds to merchants.

When a customer makes a purchase, their payment details are encrypted and sent to the gateway. The gateway then communicates with the customer’s bank to authorize the transaction. The bank’s response, approval or denial, is relayed back to the merchant. Upon approval, funds are transferred from the customer’s account to the merchant’s account through a settlement process.

APIs facilitate the integration of payment gateways with websites and applications. Security is paramount, with gateways adhering to standards like PCI DSS to protect sensitive data. Integration can be hosted, redirecting customers to the gateway’s site, or integrated, keeping the transaction on the merchant’s platform. This seamless process enables businesses to accept online payments efficiently and securely.

When integrated with Salesforce, a payment gateway allows businesses to capture and record transaction data directly within their CRM. This streamlines order management, customer relationship tracking, and reporting.

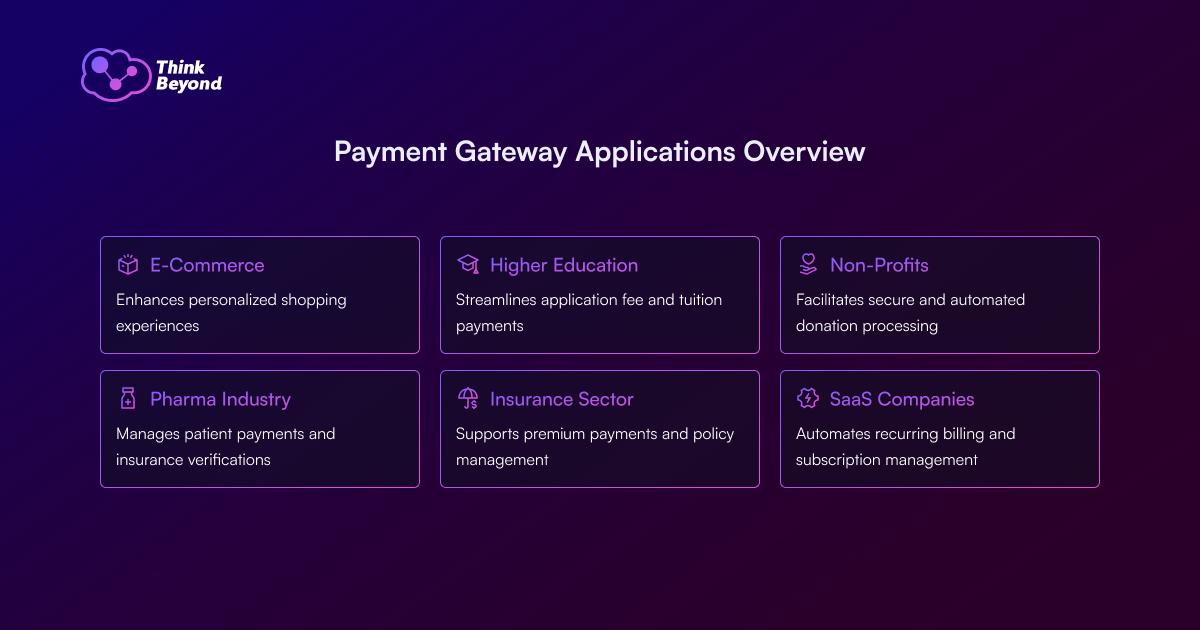

Payment Gateway Use Cases Across Industries

Payment gateways are versatile tools with applications across diverse industries. 1 Let’s explore how e-commerce, education, insurance & finance, high-tech, and nonprofits leverage payment gateways to streamline operations and enhance customer experiences.

Personalized Shopping Experiences in E-Commerce

A rapidly growing online clothing retailer leverages Salesforce Commerce Cloud to manage its storefront and a vibrant customer community built on Salesforce Experience Cloud. They aim to provide a seamless, personalized shopping experience while efficiently managing order processing and customer interactions. Customers engage within the community for style advice, product reviews, and exclusive offers. They need a payment solution that integrates with both Commerce Cloud and their community portal, allowing for saved payment methods, one-click purchases, and real-time order tracking.

Benefits:

- Seamless and secure checkout experiences directly within the customer community portal.

- Ability for customers to save payment methods, reducing checkout friction.

- One-click purchase functionality, minimizing cart abandonment.

- Real-time synchronization of sales data with Salesforce, enabling targeted marketing and personalized offers.

- Automated order processing and shipment notifications.

- Unified view of customer purchase history within their Salesforce customer record.

Application Fees in Higher Education

A university uses Salesforce Education Cloud to manage its recruitment and admissions processes. They receive thousands of applications annually and require a secure and efficient way to collect application fees and tuition payments. They also offer various payment plans and need to automate invoice generation and payment reminders. The goal is to provide a user-friendly payment experience for prospective and current students while reducing administrative overhead.

Benefits:

- Secure online application fee payments directly integrated with student records.

- Automated invoice generation and payment reminders for tuition fees, reducing manual effort.

- Flexible payment plan options, enhancing student affordability.

- Real-time tracking of payment status within Salesforce Education Cloud.

Improved financial reporting and reconciliation. - Streamlined application process.

Non-Profit Organizations Fundraising Campaigns

A non-profit organization, relies on Salesforce Nonprofit Cloud to manage its fundraising efforts. They conduct various fundraising campaigns, including online donations, recurring gifts, and event sponsorships. They need a secure and user-friendly payment solution that integrates seamlessly with their Salesforce platform to track donations, manage donor relationships, and generate insightful reports.

Benefits:

- Secure online donation processing directly within donation forms.

- Automated setup and management of recurring donations.

- Detailed reporting on donation trends, donor demographics, and campaign performance.

- Improved donor relationship management through centralized data.

- Reduced administrative burden through automated donation processing.

Ability to process donations from diverse payment methods.

Managing Patient Payments in the Pharma Industry

A pharma company provides a patient portal built on the Salesforce Experience Cloud, allowing patients to manage their prescriptions, schedule appointments, and access health information. They need a secure and compliant payment solution to process prescription refills and co-pays, while also integrating with insurance verification systems. The priority is to provide a convenient and trustworthy payment experience for patients.

Benefits:

- Secure and PCI-compliant payment processing for prescription refills and co-pays.

- Integration with insurance verification systems for streamlined billing.

- Automated payment reminders and notifications.

- Centralized patient payment history within Salesforce.

- Enhanced patient satisfaction through a seamless payment experience.

Reduction of billing errors.

Enhanced Customer Service within Insurance Sector

An insurance company uses Salesforce Financial Services Cloud to manage its broker network. They provide a broker portal where brokers can manage policies, process premium payments, and track commissions. They need a robust and secure payment solution that supports complex financial transactions and provides real-time updates to customer policies. The goal is to empower brokers and enhance customer service.

Benefits:

- Secure premium payments through the broker portal, with real-time policy updates.

- Automated commission calculation and payment processing for brokers.

- Improved broker efficiency and customer service.

- Enhanced financial reporting and reconciliation.

- Streamlined policy management.

- Increased broker satisfaction.

Saas Subscription Management

A SaaS company, uses Salesforce CPQ and Billing to manage its subscription-based services. They offer various subscription plans with different features and pricing, and they need a reliable and scalable payment solution to automate recurring billing, handle subscription changes, and manage failed payments. The priority is to maximize revenue and minimize customer churn.

Benefits:

- Automated recurring billing, reducing manual effort and errors.

- Seamless handling of subscription upgrades, downgrades, and cancellations.

- Automated dunning processes for failed payments, minimizing revenue loss.

- Detailed reporting on subscription revenue, customer lifetime value, and churn rates.

- Improved customer retention through a seamless subscription experience.

- Reduction of time spent on manual billing.

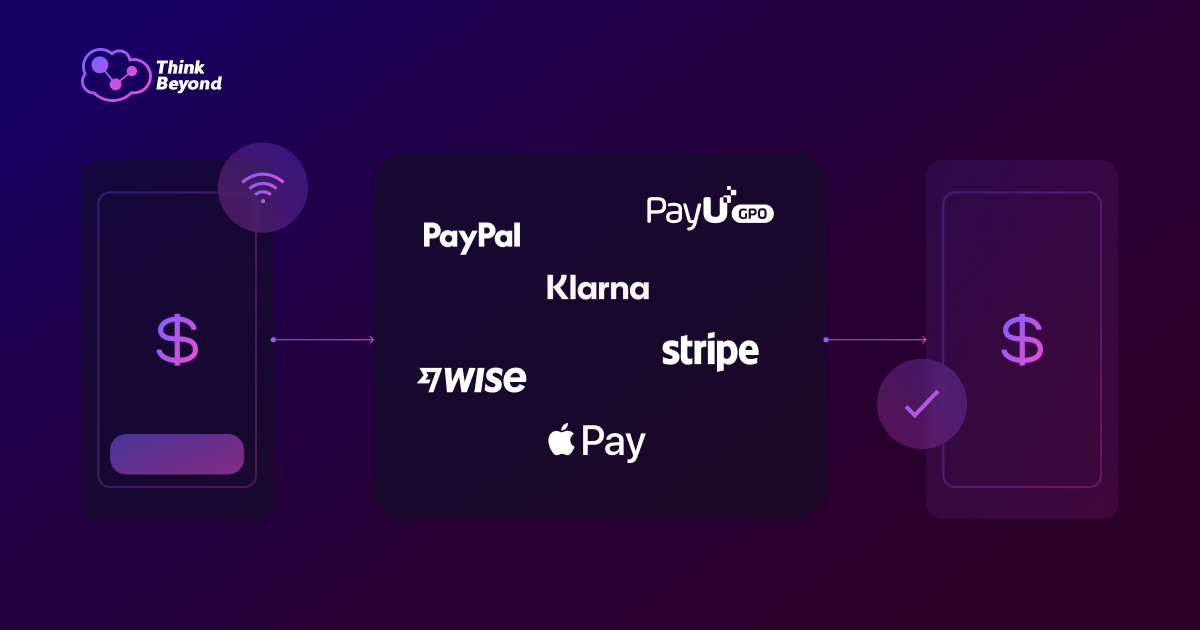

Top Payment Integration Systems for Salesforce

Here are short descriptions of each payment gateway, emphasizing their standout features and ideal users:

Stripe

Developer-centric platform offering highly customizable payment solutions via powerful APIs.

It has an extensive API documentation, broad range of integrations, robust subscription management, and strong fraud prevention. Best for online businesses requiring flexible, scalable payment processing, especially those with tech-savvy teams.

PayPal

A widely recognized and trusted digital wallet and payment processor. It offers a user-friendly interface, global acceptance, buyer protection, and easy integration with various platforms. Best for small to medium-sized businesses, online marketplaces, and individuals seeking a familiar and reliable payment option.

Apple Pay

Mobile payment and digital wallet service integrated with Apple devices. It stands out with its secure, contactless payments, seamless integration with Apple ecosystem, and enhanced user convenience. Best for businesses with mobile-focused customers, retailers with physical stores, and e-commerce platforms targeting Apple users.

Klarna

“Buy now, pay later” service offering flexible payment options for customers. It offers installment payments, deferred payments, and financing solutions, increasing purchasing power and conversion rates. Best for e-commerce businesses targeting customers who prefer flexible payment terms, particularly in retail and fashion.

Wise (formerly TransferWise)

Platform specializing in international money transfers and multi-currency accounts. It is known for its low-cost international transactions, transparent exchange rates, and multi-currency account management. Best for businesses and individuals conducting frequent international transactions, freelancers, and those with global operations.

PayU

It is a payment service provider gaining traction in emerging markets, especially in Central and Eastern Europe. Its standout features are strong local payment method support, localized solutions, and focus on emerging market needs. Best for businesses operating in or targeting emerging markets, e-commerce platforms expanding into those regions, and businesses that need to accept local payment methods.

What’s Next for Payment Gateways in the Salesforce Ecosystem?

The future of payment gateway technology and Salesforce integration is dynamic and exciting, with several key trends on the horizon:

- Real-time payments: Expect to see wider adoption of real-time payment systems, allowing for instant fund transfers between businesses and customers. This will be crucial for time-sensitive transactions and can be integrated with Salesforce for immediate order processing and confirmation.

- Embedded payments: Payment processes will become increasingly embedded within various platforms and applications, including those built on Salesforce. This means customers can complete purchases without leaving the platform, leading to smoother and more convenient experiences.

- AI-powered fraud prevention: Artificial intelligence and machine learning will play a larger role in fraud prevention, analyzing transaction data in real-time to identify and prevent suspicious activity. This can be integrated with Salesforce to enhance security and protect businesses and their customers.

These advancements, along with ongoing developments in areas like mobile payments and blockchain technology, will shape the future of payment gateway integration with Salesforce. Businesses that stay informed and adapt to these changes will be well-positioned to provide seamless, secure, and innovative payment experiences for their customers.