Veeva and Salesforce split makes a big change in the life sciences industry. It means the end of a relationship that began in 2017. This collaboration was a big deal for Veeva because it provided them access to Salesforce’s cutting-edge CRM platform and opened doors to the pharmaceutical industry.

Veeva has announced that it will be leaving Salesforce by 2023. This ends a decade-long relationship that has seen both companies work together to improve customer experiences.

The split raises questions about the future dynamics in the life sciences CRM market. While Veeva has benefited from Salesforce’s extensive reach, this move signals a new direction for the company as it seeks to establish its capabilities in an increasingly competitive landscape.

How will this affect Veeva Systems, Salesforce, and pharmaceutical customers? Let’s look at this briefly.

Veeva’s Consequences of Parting Ways with Salesforce

Veeva has established itself as a powerhouse in the life sciences sector, with annual revenues of $2 billion and a market capitalization of $28 billion. As of 2019, its solutions are used by 47 of the world’s top 50 pharmaceutical companies. The aim is to enhance the offering by migrating Salesforce’s CRM solutions to its own Veeva Vault platform.

Strategic Shift and Financial Implications

Veeva’s decision to leave San Francisco tech giant is driven by a desire to overcome the limitations of the Salesforce platform in delivering value. By developing its CRM on the Vault platform, Veeva expects to improve service quality and reduce dependence on external vendors, potentially lowering operational costs in the long term.

Customer Migration

The transition process will begin in 2025, with a five-year wind-down period that will allow existing customers to continue using Salesforce until 2030. However, Veeva expects most customers to migrate to Vault quickly.

Challenges Ahead

While the separation from Salesforce presents initial hurdles, it also provides Veeva with an opportunity to solidify its leadership position in the life sciences market by offering more specialized and efficient CRM solutions tailored to the unique needs of its customers.

Salesforce Faces Challenges After the Veeva Split

How does Salesforce feel about the split? The company will be affected because it wants to make its own niche in the life sciences sector.

-

-

- Salesforce is responding to this shift by doubling down on its efforts to develop a proprietary product tailored for the life sciences market. The company has already begun to integrate AI capabilities into its Health Cloud through Customer 360 for Health, aiming to enhance customer engagement and streamline healthcare operations.

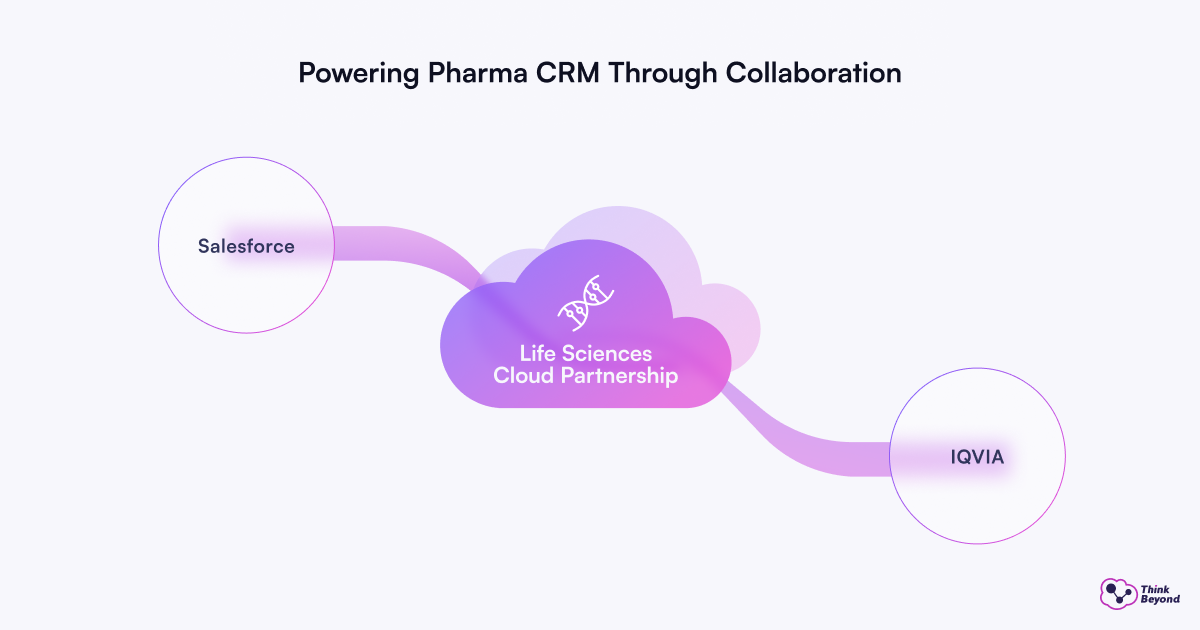

- Salesforce also announced a strategic partnership with IQVIA, which will license its OCE CRM-related software to Salesforce. The collaboration aims to accelerate the development of the Life Sciences Cloud for customer engagement, which is expected to launch in 2025. By joining forces with IQVIA, Salesforce hopes to expand its capabilities and maintain its lead in the pharmaceutical sector.

-

However, the split carries risks beyond the immediate loss of revenue (“just” $7 million in fees payable to Salesforce). Other companies that currently rely on Salesforce may be inspired by Veeva’s decision to move away from the platform, potentially leading to further customer attrition. This could create a domino effect that undermines Salesforce’s position as the No.1 CRM.

What Does the Split Mean for Pharma Clients and Their CRM?

The split between Salesforce and Veeva presents consequences for Veeva’s existing customers who now face important decisions regarding their CRM solutions.

As Veeva transitions its offerings to its Veeva CRM customers have three paths to consider:

-

-

- Stay with Veeva: Customers choosing to remain with Veeva will have access to a brand-new CRM solution. This transition entails migrating to the Vault platform, which promises enhanced features tailored to meet industry-specific needs. However, this option involves a complete overhaul of existing systems, including the creation of new data models and processes. Customers will need to navigate uncertainties regarding the replication of custom features and integrations previously available on the Salesforce platform. Staying with Veeva Systems means switching to an entirely different technology, which requires integration with existing ones. This can lead to problems and more downtime during the migration process. Additionally, the integration process can be expensive and time-consuming, increasing overall costs without guaranteed outcomes.

- Migrate to Salesforce Life Sciences Cloud: Alternatively, customers can opt to migrate to Salesforce’s Life Sciences Cloud, a next-generation customer engagement platform. This option allows them to leverage familiar interfaces and back-end functionalities while benefiting from advanced AI tools and analytics that Salesforce promises to deliver. Customers can benefit from staying with Salesforce to implement their solutions. The migration process is smoother, allowing organizations to maintain the same tech stack and technology previously utilized by Veeva. This continuity ensures familiarity and minimizes disruption. Additionally, Salesforce is backed by IQVIA, a leader in the pharmaceutical industry, which understands the nuances of pharma processes and opportunities. This partnership enhances the industry’s proven capabilities, providing customers with a reliable platform that aligns with their specific needs and best practices for effective customer engagement.

- Explore alternatives that offer a fresh perspective on the life sciences industry. Solutions such as TrueBlue and Exeevo offer agility and a strong customer focus, making them attractive choices. However, these platforms often require complicated customization, leading to lengthy implementations and increased costs. They may also lack established industry patterns and have limited AI capabilities. Furthermore, outcomes can be unclear, leaving organizations uncertain as to whether they will achieve their desired results.

-

The split between Salesforce and Veeva is good news for life sciences companies, which now have the opportunity to reassess their CRM strategies. Each option has its own set of benefits and challenges, so it’s important for organizations to carefully evaluate their specific needs and operational requirements before deciding. As Veeva Systems, Salesforce, and IQVIA evolve in this competitive landscape, customers will have the opportunity to shape their future engagement with these leading platforms in the life sciences industry.

If you have any questions about Salesforce solutions for the pharmaceutical industry, seamless integration of CRM solutions, or developments in the commercial life sciences space, please contact us.

Want to work with us?

Successful Salesforce projects begin with thorough analysis and detailed design.

Let’s talk about your needs